30/11/ · Forex Percentage Price Oscillator PPO Indicator What does Forex Indicator mean? A forex indicator is a statistical tool that currency traders use to make judgements about the direction of a currency pair’s price blogger.comted Reading Time: 1 min 19/07/ · The percentage price oscillator (PPO) is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. The moving averages are a period and 12 The Percentage Price Oscillator (PPO) forex strategy is a strategy that uses the wit of the PPO custom indicator to gauge the difference between two moving averages. In the form of a percentage of the bigger moving average, while also relying on the 3c_Turbo_JRSX custom indicator to deliver buy and sell blogger.comted Reading Time: 3 mins

Percentage Price Oscillator (PPO) Definition

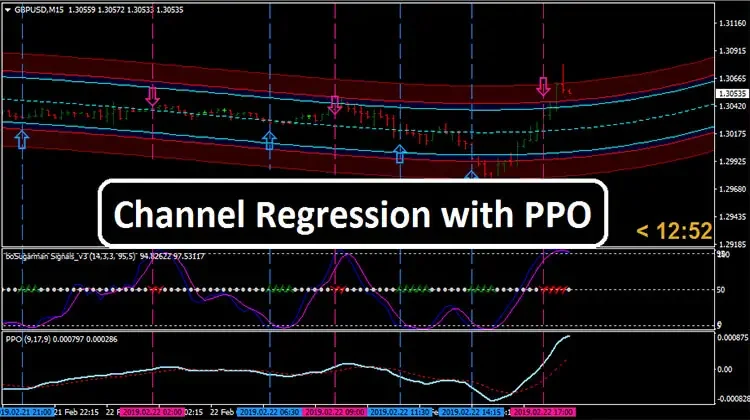

The percentage price oscillator PPO is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. The moving averages are a period and period exponential moving average EMA. The PPO is used to compare asset performance and volatility, spot divergence that could lead to price reversals, ppo indicator and forex, generate trade signals, ppo indicator and forex, and help confirm trend direction.

Use the following formula to calculate the relationship between two moving averages for a holding. The PPO ppo indicator and forex identical to the moving average convergence divergence MACD indicator, except the PPO measures percentage difference between two EMAs, while the MACD measures absolute dollar difference. Some traders prefer the PPO because readings are comparable between assets with different prices, whereas MACD readings are not comparable.

The PPO generates trade signals in the same way the MACD does. The indicator generates a buy signal when the PPO line crosses above the signal line from below, and generates a sell signal when the PPO line crosses below the signal from above. The signal line is created by taking a nine-period EMA of the PPO line. When the PPO is above zero that helps confirm an uptrend since the short-term EMA is above the longer-term EMA.

Conversely, when the PPO is below zero, the short-term EMA is below the longer-term EMA, which is an indication of a downtrend. Some traders prefer to only take signal line buy signals when the PPO is above zero, or the price shows an overall upward trajectory. Similarly, when the PPO is below zero, they may ignore buy signals, or only take short-sell signals.

Centerline crossovers also generate trading signals. Traders consider a move from below to above the centerline as bullishand a move from above to below the centerline as bearish. The PPO crosses the centerline when the period and period moving average cross. Traders can also use the PPO to look for technical divergence between the indicator and price. For example, ppo indicator and forex, if the price of an asset makes a higher high but the indicator makes a lower high, it may indicate the upward momentum is subsiding.

Conversely, if an asset's price makes a lower low but the indicator makes a higher low, it could suggest that the bears are losing their traction and the price could head higher soon.

This is particularly useful if the assets vary significantly in price. This is a very rough comparison of volatility between the two assets. The indicator is only measuring and reflecting the distance between two moving averages, not actual price movement.

The PPO indicator is also useful for comparing momentum between assets. Traders simply need to look at which asset has a higher PPO value to see which has more momentum. For instance, if Apple has a PPO of three and Amazon has a PPO value of one, then Apple has had more recent strength since its short-term EMA is further above the longer-term EMA. The PPO measures the distance between a shorter and longer-term EMA.

The relative strength index RSI is another type of oscillator that measures recent price gains and losses. The RSI is used to help assess overbought and oversold conditionsas well as spot divergences and confirm trends. The indicators are calculated and interpreted differently, so they will each provide different information to traders. The PPO is prone to providing false crossover signalsboth in terms of signal line crossovers and centerline crossovers.

Assume the price is rising, but then moves sideways. The two EMAs will converge during the sideways period, likely resulting in a signal line crossover and potentially a centerline crossover. Yet the price hasn't actually reversed or ppo indicator and forex direction, it just paused.

Traders using the PPO must keep this in mind when using the PPO to generate trade signals. Two or more crossovers may occur before a strong price move develops.

Multiple crossovers without a significant price move are likely to result in multiple losing trades. The indicator is also used to spot divergences, which may foreshadow a ppo indicator and forex reversal. Yet divergence is not a timing signal. It can ppo indicator and forex a long time, and won't always result ppo indicator and forex a price reversal.

The indicator is composed of the distance between two EMAs the PPOand an EMA of the PPO signal line. There is nothing inherently predictive in these calculations. They are showing what has occurred, and not necessarily what will happen in the future.

Technical Analysis Basic Education. Your Money. Ppo indicator and forex Finance. Your Practice. Popular Courses. Technical Analysis Guide to Technical Analysis Technical Analysis Basic Education Advanced Technical Analysis Concepts. Technical Analysis Technical Analysis Basic Education. What Is the Percentage Price Oscillator PPO? Key Takeaways The PPO typically contains two lines: the PPO line, and the signal line.

The signal line is an EMA of the PPO, so it moves slower than the PPO. The PPO crossing the signal line is used by some traders as a trade signal. When it crosses above from below that is a buy, and when it crosses below from above that is a sell. When the PPO is above zero that helps indicate an uptrend, as the short-term EMA is above the longer-term EMA.

When the PPO ppo indicator and forex below zero, the short-term average is below the longer-term average, which helps indicate a downtrend. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Investopedia does not include all offers available in the marketplace. Related Terms Moving Average Convergence Divergence MACD Moving Average Convergence Divergence MACD is defined as a trend-following momentum indicator that shows the relationship between two moving averages of a security's price.

Qstick Indicator Definition and Uses The Qstick Indicator is a technical analysis indicator developed by Tushar Chande to show buying and selling pressure over time. Relative Strength Index RSI The Relative Strength Index RSI is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions.

Oscillator of a Moving Average OsMA OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time, ppo indicator and forex. It can be used to confirm trends and provide trade signals. Trigger Line Definition and Example Trigger line refers to a moving average plotted on a MACD indicator that is used to generate buy and sell signals in a security.

Partner Links. Related Articles. Technical Analysis Basic Education Percentage Price Oscillator — An 'Elegant Indicator', ppo indicator and forex. Technical Analysis Basic Education How do moving average convergence divergence MACD and relative strength Index RSI differ?

Technical Analysis Basic Education Adaptive Price Zone Technical Indicator Explained. Technical Analysis Basic Education How to Interpret the Volume Zone Oscillator. Technical Analysis Basic Education Simple vs. Exponential Moving Averages: What's the Difference? About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Better MACD Indicator that you are not using to do this

, time: 2:50Percentage Price Oscillator (PPO) | Forex Indicators Guide

19/07/ · The percentage price oscillator (PPO) is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. The moving averages are a period and 12 The Percentage Price Oscillator (PPO) forex strategy is a strategy that uses the wit of the PPO custom indicator to gauge the difference between two moving averages. In the form of a percentage of the bigger moving average, while also relying on the 3c_Turbo_JRSX custom indicator to deliver buy and sell blogger.comted Reading Time: 3 mins 30/11/ · Forex Percentage Price Oscillator PPO Indicator What does Forex Indicator mean? A forex indicator is a statistical tool that currency traders use to make judgements about the direction of a currency pair’s price blogger.comted Reading Time: 1 min

No comments:

Post a Comment