27/04/ · Sentiment Analysis. Sentiment analysi s is used to gauge how other traders feel, whether it’s about the overall currency market or about a particular currency pair. Earlier, we said that price action should theoretically reflect all available market information. Unfortunately for us forex traders, it isn’t that simple 05/12/ · Market sentiment analysis is an analysis that focuses on measuring the overall psychological and emotional state of all who are entering the market. This analytical method attempts to quantify how many percent of the Forex market participant is in favor of an uptrend or a blogger.comted Reading Time: 3 mins 04/11/ · As forex traders, it is our job to gauge what the market is feeling. One way to gauge market sentiment extremes is through the Commitment of Traders Report. By understanding the activities of the three groups of traders (commercial traders, non-commercial, retail traders), we can find ourselves in better positions to fish for tops and blogger.comted Reading Time: 2 mins

Sentiment Analysis for Forex Trading

Market sentiment indicators refer to the psychology or emotions of market participants. While every trader struggles with his or her own emotional issues during trading, the mass of traders the crowd tend to trade in concert to an emotional pendulum that vacillates between fear and greed.

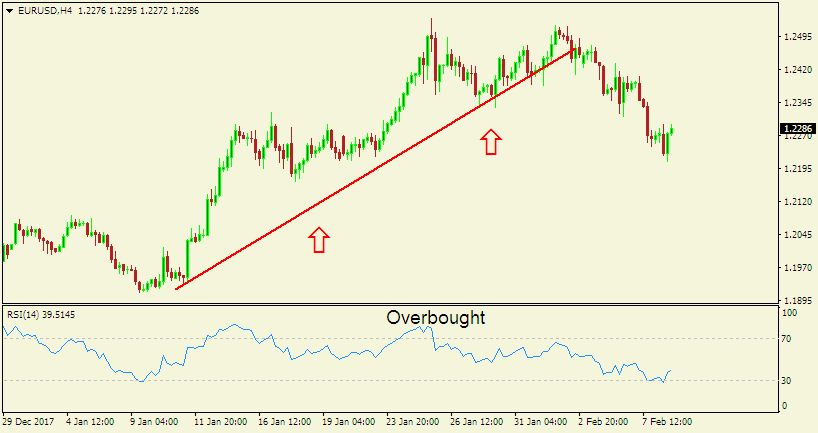

Learn in this article how how to read sentiment analysis forex analyze the Forex sentiment indicators and the emotions of market participants; the net amount of optimism or pessimism reflected in any asset's performance. At times traders act out of fear and pessimism, and at other times they act out of greed, hope, and overconfidence. Adding to these emotional extremes are a number of crowd related trading biases. This article will briefly examine psychological makeup of market sentiment, and why the crowd is often wrong, and then illustrate some effective gauges of crowd trading activity, called market sentiment indicators, in order to trade in the opposite direction of the crowd with contrarian strategies.

When emotion becomes excessive and prices thereby deviate substantially from the norm, a price reversal is usually due, a reversion to the mean. It is thus important for the technical analyst to know when prices are reflecting emotional extremes. I remember when I had traded that period I had initially started out with what I thought was a well-balanced set of long and short trend strategies. But as my short strategies had tended to be stopped out, and my long strategies had tended to be profitable, I had become to be overconfident in the continual rise of the Euro against the Dollar, and began to drop my short strategies and add to my long strategies, how to read sentiment analysis forex.

I had become net long the Euro. I was joined by countless other market participants who felt the same way, how to read sentiment analysis forex. We all believed that the EURUSD, as well as all currencies pitted against the dollar, could see higher highs, and for a while, our optimistic view of all most non-dollar currencies or pessimistic view of the US dollar did drive Euro prices higher, till they peaked at 1.

The EURUSD was not only the market that had peaked that year, as many other currency pairs, commodities, and stocks had also peaked. The upward mania had spread across the board to all financial assets, causing a bubble effect. The bubble effect is when emotional excess in the form of overconfidence, hope and greed leads to extraordinary rises in prices, whether in the stock market, gold, currency, or tulip bulbs. During a bubble the market prices are much higher than mean, or average, making newer and more irrational highs.

The existence of bubbles is proof that prices are not always determined rationally and that emotion can get hold of the market and through positive feedback run prices far beyond any reasonable value before reversing.

Although bubbles occur infrequently they occur considerably more than expected. Case in point was the last housing and commodity and currency bubble ofas described above. The bubble before that was the tech bubble ofwhen security prices in the technology sector had astronomical price-earnings ratios.

There seemed to be hardly a breathing space between the two bubbles. When the bad news crept in from the banks about their toxic assets, traders became pessimistic and fearful and began to sell off Euro and move into the safer reserve currency of the US dollar. How to read sentiment analysis forex this level of pessimism rises in the market, more traders sell, and the currency falls more.

These falling prices then lead to more and more traders to be fearful and sell. Fear begets more fear, panic fuels more panic, with the currency falling by leaps and bounds in just a few short weeks.

This downward mania becomes known as a market crash or panic. The market crash or panic is when emotional excess in the form of pessimism, doubt and fear leads to extraordinary falls in prices. They usually occur as a result of a bubble popping.

The market crash of July-Nov was the most recent case in point. The emotional-psychological force behind a market bubble or crash is what is known as the sentiment.

The emotional extremes of fear and greed can lead the majority of investors the crowd to ramp up a bubble and then when it pops, to send the market down in a terrible crash. Understanding the links between emotions, crowd behavior, and currency prices can help the technical analyst profit by spotting market extremes and trading contrary to the herd.

Note : the technical analysts must remember that they are subject to the same human biases as other investors and thus must be on guard against them. The worst enemy is the investor himself. In the following pages will focus more on how to profit from trading against the crowd and emotional extremes, how to read sentiment analysis forex.

We will be asking, how can we identify market extremes via different measurements of sentiment, called sentiment indicators, in time to trade against these extremes?

We will be examining the worthiness of four popular forex correlated sentiment indicators taken from currency futures and options, and three popular forex specific sentiment indicators derived from the trading books of large FX brokerages.

Articles menu How to Analyze Forex Sentiment. What is Sentiment? Example of Pessimism, Doubt and Fear. Market Crash or Panic The market crash or panic is when emotional excess in the form of pessimism, doubt and fear leads to extraordinary falls in prices.

Trading Against the Herd The emotional extremes of fear and greed can lead the majority of investors the crowd to ramp up a bubble and then when it pops, to send the market down in a terrible crash. Is this article helpful? Share it with a friend HTML Comment Box is loading comments You might also like to read:. Share this page using your affiliate referral link Academy Home.

Learn Forex. What is Forex and How to Trade it - Best Beginner's Guide. How to Trade Forex: Step-by-step Guide. How Technical Analysis Works. How Fundamental Analysis Works. How Support and Resistance Works. How Trend Analysis Works. How to Properly Manage Risk. How to Analyze Fundamentals. Best Time to Trade Forex, how to read sentiment analysis forex.

Why do Most Traders Lose Money in Forex. How to read sentiment analysis forex are Forex Rebates. Introduction to Automated Trading. Forex Brokers. Top 5 FX Brokers With Customer's Reviews, how to read sentiment analysis forex. Top US Regulated Forex Brokers. Financial and Forex Regulators. Finding the Best Forex Broker: 7 Key Factors. Benefits of Micro and Nano Lot Brokers. Technical Indicators.

Forex Basics. Training Videos. Academy Home. Sign Up. Remember Me. Join our mailing list? Forgotten Password.

How to Read Trader Sentiment (Forex \u0026 Indices)

, time: 21:16How to Analyze Forex Sentiment

05/12/ · Market sentiment analysis is an analysis that focuses on measuring the overall psychological and emotional state of all who are entering the market. This analytical method attempts to quantify how many percent of the Forex market participant is in favor of an uptrend or a blogger.comted Reading Time: 3 mins 05/07/ · Forex sentiment analysis is the process of identifying the positioning of traders, whether net long or net short, to influence your own trading decisions in the currency blogger.comted Reading Time: 4 mins Forex market sentiment represents a vital element for traders in their fundamental analysis review of the market, and it gives the forex trader a perspective into how the general market — or key segments of it — feels about both direction, as well as a number of important market Estimated Reading Time: 14 mins

No comments:

Post a Comment