01/01/ · The margin requirement for a trade of 20, units (or lots in the MT4) is $ (we showed the margin calculation earlier). The free margin would be $ (the equity) – $ (margin requirement) = $9,Estimated Reading Time: 6 mins For example, if your account balance is $20,, your leverage is set to and you want to initiate a position of standard lots (or 10, units of currency) at EUR/USD at a market price of then minimum margin requirement would be the amount of $14,/5(2) Volume in Lots: 5 (One Standard Lot = , Units) Leverage: Account Base Currency: USD Currency Pair: EUR/USD Exchange Rate: (EUR/USD) Required Margin = , / * Required margin is $ USD

04 - How to Trade Forex - Action Forex

All currencies in forex 200 000 lots margin requirements trading are quoted in pairs, one against another. Their names are given as a three letter abbreviation known as ISO code, where the first two letters represent the country and the third one is the name of the currency. Currency rate always represents the value of the base first currency expressed in the quote second currency.

In Forex there are two prices given — Bid and Ask- the former shows how much of the quote currency is required to sell 1 unit of the base currency and the later represents how much will be required to buy it.

Ask price is higher than bid. The difference between two prices is referred as to spread, which is usually measured in pips or points. Previously, when only 4 digit precision was available, pip, or percentage in point, was the smallest unit to measure price fluctuations.

With the introduction of more accurate 5 digit precision pricing the smallest unit of price change is called point, however 1 pip is still calculated by 4th digit. For example, if Bid price is 1. Closing order is always opposite to the opening one, that is, by closing a long buy position you sell the amount back and vise versa — when you close a short sell position, you buy the amount you previously sold.

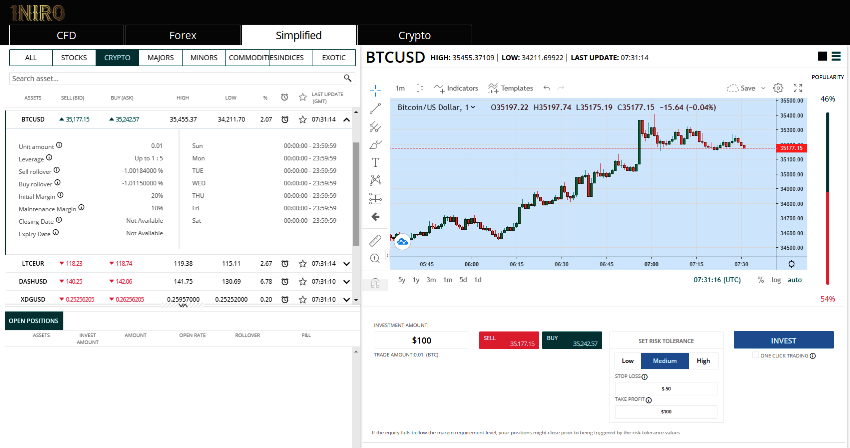

A position can either be closed manually at the current market rate or when a certain price level is reached, through Stop Loss and Take Profit orders. In order to gain profit you need to close long positions when the price goes up and close short position forex 200 000 lots margin requirements the price goes down. To open a position you need to have a certain amount in your balance, which is commonly referred as to required margin or just margin.

The amount depends on the trading tool, forex 200 000 lots margin requirements, volume and leverage. For example, if your leverage is and you open 0. Required margin is always calculated automatically by the platform. To check how much approximately will be required to open a certain position, you can use our Forex Calculator. When you open a position, note that your balance remains intact.

In fact, it only includes deposits, withdrawals and closed trades. Free margin is the funds you can open positions with. Note that when you open a hedge order with the same volume, no margin will be required; however, if your free margin is negative, you will not be able to open an opposite position. Basically, all you need to do to start trading forex is to open an account and download and install trading platform or sign in to the MT4 or cTrader web based terminal.

Demo account allows you to practice risk free, while with a real account you will be able to experience real market with minimum deposit as low as 5 USD. If you are not familiar with the trading platform, make sure to check our Manuals section for detailed instructions. More information on how the forex market works, what tools and techniques you can employ to predict the direction of forex 200 000 lots margin requirements prices or strategies you can apply is available in the Forex Basics section.

If you have any questions regarding the market, OctaFX website or trading conditions you can check our elaborate and comprehensive FAQ. Whenever you encounter an unfamiliar term, word or market phenomena, you can check its definition and description in the Forex Glossary. com was set up back in with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade.

Empowering the individual traders was, is, and will always be our motto going forward. Contact us: contact actionforex. Thu, Sep 23, GMT. Contact Us Newsletters. Sign in. your username. your password. Forgot your password? Get help. Privacy Policy.

Password recovery. your email. Action Forex. BOE Downgraded Short-Term Growth, but Turned Slightly More Hawkish about Tightening. Sterling Rebounds on Hawkish BoE Surprise, Risk Sentiments Improved. Markets Responded Positively to FOMC, forex 200 000 lots margin requirements, Sterling Stays Soft ahead of BoE. US Crude Oil Inventory Fell More than Expected, while Gasoline Stockpile….

Home Tutorials Forex Basics 04 - How to Trade Forex. By OctaFX. Jul 08 17, GMT. Stay udpated with our FREE Forex Newsletters. Download our Free Forex Ebook Collection, forex 200 000 lots margin requirements.

OctaFX provides forex brokerage services to its clients in over countries around the world. OctaFX uses the most up-to-date technology and knowledge to make your forex trading experience incredibly convenient. Our top goal is the trust and satisfaction of each client's needs and requirements. OctaFX sets the highest service level standards and maintains them, as well as constantly developing new services and promotions.

Featured Analysis. Load more. Learn Forex Trading. What is Bull and Bear in Forex Market Feb 12 19, GMT. Should You Let Your Trades Stop Out? Aug 01 18, forex 200 000 lots margin requirements, GMT.

Approaching Money Management Jul 10 18, GMT. Best Practices that Maintain and Restore Mental Energy for Trading Apr 22 19, GMT. Fundamental Analysis in Forex Trading Jul 26 18, GMT. com © All rights reserved, forex 200 000 lots margin requirements. About Us Advertising RSS Newsletters Contact Us Disclaimers Privacy Policy.

By continuing to browse our site you agree to our use of cookies, privacy policy and terms of service. Accept Reject Read More. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website.

Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience.

Necessary Necessary. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website.

These cookies do not store any personal information. Non-necessary Non-necessary. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

This IS WHY Most BEGINNERS Lose Their ACCOUNTS (What Is Leverage?)

, time: 24:32Margin Requirements, Forex Margin Requirements | Calculate Forex Margin

Let’s say one of the FX pairs you are going to trade is the EURUSD, which is the first item at the top of the picture. Then the next item is leverage, in this case, , followed by account currency, USD, and lot size, 1. When you click on calculate for the above data, you get a margin requirement of $11,Estimated Reading Time: 8 mins For example, if your account balance is $20,, your leverage is set to and you want to initiate a position of standard lots (or 10, units of currency) at EUR/USD at a market price of then minimum margin requirement would be the amount of $14,/5(2) lots GBPCHF = GBP * (lot size) * (the GBPUSD rate at the moment of this used 4 types of lots in Forex. They are presented in the below table: Lot Number of units less money is required for the trade margin and therefore, the less is the trade cost

No comments:

Post a Comment