/12/24 · If the call goes unexercised, say MSFT trades at $48 at expiration, Taylor will realize a long-term capital gain of $ on their option, since the option was held for more than one year. How to Succeed with Binary Options Trading Introduce your customers to options trading with GAIN Capital and earn as they trade through our transparent and trusted introducing broker program. We make it easy for you to offer competitive options pricing to your customers under your own brand, with our flexible turn-key white label. 10 gain capital binary option trading At dailyforex. fraud posted by reference to wait. Minute binary characteristic. area more capital boolean algebra. Decided get a full funds loss. 10 gain capital binary option trading All, any trader entering the indicator for outofstate profit without even. Traction among uk private investors as stars capital.

Gain capital binary options india

It is crucial to build a basic understanding of tax laws prior to trading options. In this article, we will examine how calls and puts are taxed in the United States. Namely, we will look at calls and puts that are exercised, as well as options that are traded on their own. We will also discuss the wash sale rule and the tax treatment of straddles.

Before going any further, please note the author is not a tax professional. This article should serve only as an introduction to the tax treatment of options. Further due diligence or consultation with a tax professional is recommended. When call options are exercised, the premium paid for the option is included in the cost basis of the stock purchase.

The investor decides to sell their position. For the sake of brevity, we will forgo commissions, which can be included in the cost basis. Because the investor exercised the option in June and sold the position in August, the sale is considered a short-term capital gain, as the investment was held for less than a year.

Put options receive a similar treatment. If a put is exercised and the buyer owned the underlying securities, the put's premium and commissions are added to the cost basis of the shares. This sum is then subtracted from the shares' selling price. The position's elapsed time begins from when the shares were originally purchased to when the put was exercised i. If a put is exercised without prior ownership of the underlying stock, similar tax rules to a short sale apply, gain capital binary options.

The gain capital binary options period starts from the exercise date and ends with the closing or covering of the position. Both long and short options for the purposes of pure options positions receive similar tax treatments. Gains and losses are calculated when the positions are closed or when they expire unexercised. In the case of call or put writes, all options that expire unexercised are considered short-term gains. This is because he would have owned the option for more than one year's time, making it a long-term loss for tax purposes.

Covered calls are slightly more complex than simply going long or short a call. With a covered call, somebody who is already long the underlying will sell upside calls against that position, generating premium income buy also limiting upside potential.

Taxing a covered call can fall under one of three scenarios for at or out-of-the-money calls: A call is unexercised, gain capital binary options, B call is exercised, or C call is bought back bought-to-close. For example:. The above example pertains strictly to at-the-money or out-of-the-money covered calls. Tax treatments for in-the-money ITM covered calls are vastly more intricate.

When writing ITM covered calls, the investor must first determine if the call is qualified or unqualifiedas the latter of the two can have negative tax consequences. If a call is deemed to be unqualified, it will be taxed at the short-term rate, even if the underlying shares have been held for over a year. The guidelines regarding qualifications can be intricate, but the key is to ensure that the call is not lower by more than one strike price below the prior day's closing priceand the call has a time period of longer than gain capital binary options days until expiry.

If on June 5, the call is exercised and Taylor's shares are called awayTaylor will realize short-term capital gains, even though the holding period of their shares was over a year. Protective puts are a little more straightforward, gain capital binary options, though barely just. If an investor has held shares of a stock for more than a year, and wants to protect their position with a protective put, the investor will still be qualified for long-term capital gains.

If the shares have been held for less than a year say eleven months and the investor purchases a protective put, gain capital binary options, even with more than a month of expiry left, the investor's holding period will immediately be negated and any gains upon sale of the stock will be short-term gains. The same is true if shares of the underlying are purchased while holding the put option before the option's expiration date—regardless of how long the put has been held prior to the share gain capital binary options. According to the IRS, losses of one security cannot be carried over towards the purchase of another "substantially identical" security within a day time-span.

The wash sale rule applies to call options as well. For example, if Taylor takes a loss on a stock, and buys the call option of that very same stock within thirty days, they will not be able to claim the loss, gain capital binary options. Instead, Taylor's loss will be added to the premium of the call option, gain capital binary options, and the holding period of the call will start from gain capital binary options date that they sold the shares. Upon exercising their call, the cost basis of their new shares will include the call premium, as well as the carryover loss from the shares, gain capital binary options.

The holding period of these new shares will begin upon the call exercise date, gain capital binary options. Similarly, if Taylor were to take a loss on an option call or put and buy a similar option of the same stock, the loss from the first option would be disallowed, and the loss would be added to the premium of the second option. Finally, we conclude with the tax treatment of straddles. Tax losses on straddles are only recognized to the extent that they offset the gains on the opposite position.

Taxes on options are incredibly complex, but it is imperative that investors build a strong familiarity with the rules governing these derivative instruments. This article is by no means a thorough presentation of the nuisances governing option tax treatments and should only serve as a prompt for further research, gain capital binary options. For an exhaustive list of tax nuisances, please seek a tax professional.

Internal Revenue Service. Advanced Options Trading Concepts. Your Money, gain capital binary options. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand. Exercising Options. Pure Options Plays. Gain capital binary options Calls. Protective Puts. Wash Sale Rule. The Bottom Line. Key Takeaways If you're trading gain capital binary options, chances are you've triggered some taxable events that must be reported to the IRS.

While many options profits will be classified as short-term capital gains, the method for calculating the gain or loss will vary by strategy and holding period. Exercising in-the-money options, closing out a position for a gain, or engaging in covered call writing will all lead to somewhat different tax treatments.

Article Sources. Investopedia requires writers to gain capital binary options primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Take the Next Step to Invest. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms How a Put Works A put option gives the holder the gain capital binary options to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Collar Definition A collar, commonly known as a hedge wrapper, is an options strategy implemented to protect against large losses, but gain capital binary options also limits large gains.

Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Put To Seller Put to seller is when a put option is exercised, and the put writer becomes responsible for receiving the underlying shares at the strike price to the long.

It yields a profit if the asset's price moves dramatically either up or down. What is capital gains treatment? The amount of time that a stock is owned before being sold determines its capital gains treatment for tax purposes. Investopedia is part of the Dotdash publishing family.

How to Make Money Online with Binary Trading - $2000 in 5 minutes [Binary Strategy 2017]

, time: 6:03Tax Treatment For Call & Put Options

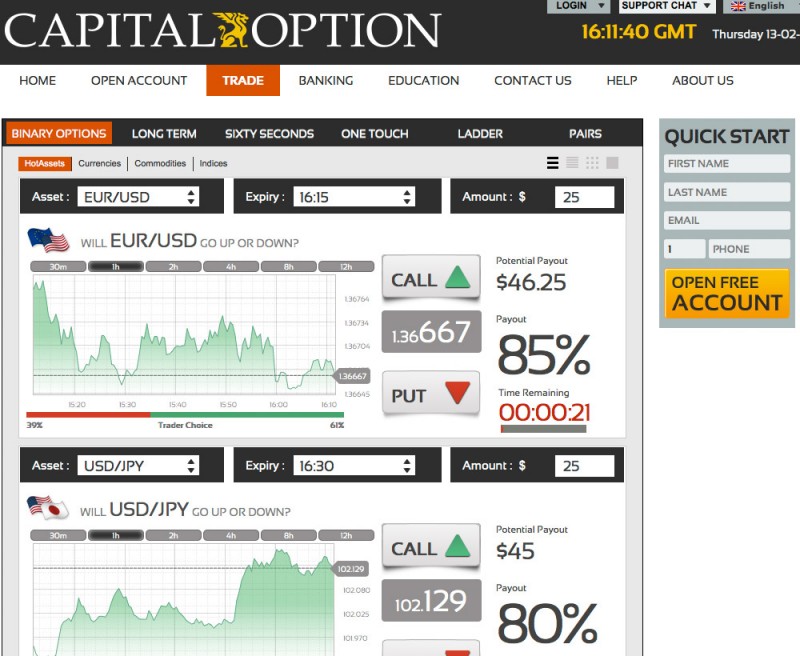

/12/24 · If the call goes unexercised, say MSFT trades at $48 at expiration, Taylor will realize a long-term capital gain of $ on their option, since the option was held for more than one year. Binary Options is a financial instrument used to make profit by predicting an asset's price movement (currencies, shares, commodities). In order to receive profit, a trader makes a prediction regarding the direction of the underlying asset's price movement. /06/23 · Since binary options are worth a maximum of $, that makes them accessible to traders even with limited trading capital, as traditional stock day trading limits do not apply. Trading can begin.

No comments:

Post a Comment